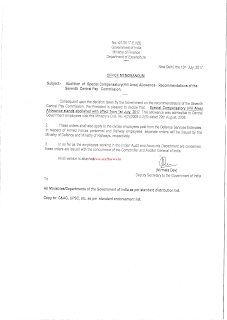

7th CPC TA Rules: Entitlement for Journeys on Tour or Training

Annexure to Ministry of Finance, Department of Expenditure

In supersession of Department of Expenditure’s O.M. No. 19030/3/2008-E.IV dated 23.09.2008, in respect of Travelling Allowance the following provisions will be applicable with effect from 01.07.2017 :

2.Entitlements for Journeys on Tour or Training

A.(i) Travel Entitlements within the Country

| Pay Level in Pay Matrix | Travel entitlement |

| 14 and above | Business/Club class by aft or AC-I by train |

| 12 and 13 | Economy class by air or AC-I by train |

| 6 to 11 | Economy class by air or AC-II by train |

| 5 and below | First Class/AC-III/AC Chair car by train |

(ii) It has also been decided to allow the Government officials to travel by Premium Trains/Premium Tatkal Trains/Suvidha Trains, the reimbursement to Premium Tatkal Charges for booking of tickets and the reimbursement of Dynamic/Flexi-fare in Shatabdi/Rajdhani/Duronto Trains while on official tour/ training. Reimbursement of Tatkal Seva Charges which has fixed fare, will remain continue to be allowed. Travel entitlement for the journey in Premium/Premium Tatkal/Suvidha/ Shatabdi/Rajdhani/ Duronto Trains will be as under :-

| Pay Level in Pay Matrix | Travel entitlement in Premium/Premium Tatkal/Suvidha/ Shatabdi/Rajdhani/ Duronto Trains |

| 12 and above | Executive/AC 1st Class (In case of Premium/PremiumTatkal/Suvidha/Shatabdi/Rajdhani Trains as per available highest class) |

| 6 to 11 | AC 2nd Class/Chair Car (In Shatabdi Trains) |

| 5 & below | AC 3rd Class/Chair Car |

(iii) The revised Travel entitlements are subject to following:-

a.In case of places not connected by rail, travel by AC bus for all those entitled to travel by AC II Tier and above by train and by Deluxe/ordinary bus for others is allowed.

b.In case of road travel between places connected by rail, travel by any means of public transport is allowed provided the total fare does not exceed the train fare by the entitled class.

c.All mileage points earned by Government employees on tickets purchased for official travel shall be utilized by the concerned department for other official travel by their officers. Any usage of these mileage points for purposes of private travel by an officer will attract departmental action. This is to ensure that the benefits out of official travel, which is funded by the Government, should accrue to the Government .

d.In case of non-availability of seats in entitled class, Govt. servants may travel in the class below their entitled class.

[post_ads]

B. International Travel Entitlement :

| Pay Level in Pay Matrix | Travel entitlement |

| 17 and above | First class |

| 14 to 16 | Business/Club class |

| 13 and below | Economy class |

C. Entitlement for journeys by Sea or by River Steamer

(i) For places other than A&N Group of Islands and Lakshadweep Group of Island :-

| Pay Level in Pay Matrix | Travel entitlement |

| 9 and above | Highest class |

| 6 to 8 | Lower class if there be two classes only on the steamer |

| 4 and 5 | If two classes only, the lower class. If three classes, the middle or second class. If there be four classes, the third class |

| 3 and below | Lowest class |

(ii) For travel between the mainland and the A&N Group of Islands and Lakshadweep Group of Island by ships operated by the Shipping Corporation of India Limited :-

| Pay Level in Pay Matrix | Travel entitlement |

| 9 and above | Deluxe class |

| 6 to 8 | First/’A’ Cabin class |

| 4 and 5 | Second/’B’ Cabin class |

| 3 and below | Bunk class |

D. Mileage Allowance for Journeys by Road :

(i)At places where specific rates have been prescribed :-

| Pay Level in Pay Matrix | Travel entitlement |

| 9 and above | Actual fare by any type of public bus including AC bus

OR

At prescribed rates of AC taxi when the journey is actually performed by AC taxi

OR

At prescribed rates for auto rickshaw for journeys by auto rickshaw, own car, scooter, motor cycle, moped, etc. |

| 6 to 8 | Same as above with the exception that journeys by AC taxi will not be permissible. |

| 4 and 5 | Actual fare by any type of public bus other than AC bus

OR

At prescribed rates for auto rickshaw for journeys by auto rickshaw, own car, scooter, motor cycle, moped, etc. |

| 3 and below | Actual fare by ordinary public bus only

OR

At prescribed rates for auto rickshaw for journeys by autorickshaw, own scooter, motor cycle, moped, etc, |

(ii) At places where no specific rates have been prescribed either by the Directorate of Transport of the concerned State or of the neighboring States:

| For journeys performed in own car/taxi | Rs. 24/- per Km |

| For journeys performed by auto rickshaw, own scooter, etc. | Rs. 12/- per Km |

E(i). Daily Allowance on Tour

| Pay Level in Pay Matrix | Travel entitlement |

| 14 and above | Reimbursement for hotel accommodation/guest house of up to 7,500/- per day,

Reimbursement of AC taxi charges as per actual expenditure commensurate with official engagements for travel within the city and Reimbursement of food bills not exceeding 1200/- per day |

| 12 and 13 | Reimbursement for hotel accommodation/guest house of up to 4,500/- per day, Reimbursement of AC taxi charges of up to 50 km per day for travel within the city, Reimbursement of food bills not exceeding 1000/- per day. |

| 9 to 11 | Reimbursement for hotel accommodation/guest house of up to 2,250/- per day, Reimbursement of non-AC taxi charges of up to 338/- per day for travel within the city, Reimbursement of food bills not exceeding 900/- per day. |

| 6 to 8 | Reimbursement for hotel accommodation/guest house of up to 750 per day,

Reimbursement of non-AC taxi charges of up to 225/- per day for travel within the city, Reimbursement of food bills not exceeding 800/- per day. |

| 5 and below | Reimbursement for hotel accommodation/guest house of up to 450 per day,

Reimbursement of non-AC taxi charges of up to 113/- per day for travel within the city, Reimbursement of food bills not exceeding 500/- per day. |

.

ii.Reimbursement of Hotel charges :- For levels 8 and below, the amount of claim (up to the ceiling) may be paid without production of vouchers against self-certified claim only. The self-certified claim should clearly indicate the period of stay, name of dwelling, etc. Additionally, for stay in Class ‘X’ cities, the ceiling for all employees up to Level 8 would be X1,000 per day, but it will only be in the form of reimbursement upon production of relevant vouchers. The ceiling for reimbursement of hotel charges will further rise by 25 percent whenever DA increases by 50 persent

iii. Reimbursement of Travelling charges :- Similar to Reimbursement of staying accommodation charges, for levels 8 and below, the claim (up to the ceiling) may be paid without production of vouchers against self- certified claim only. The self-certified claim should clearly indicate the period of travel, vehicle number, etc. The ceiling for levels 11 and below will further rise by 25 percent whenever DA increases by 50 percent. For journeys on foot, an allowance of Rs.12/- per kilometer travelled on foot shall be payable additionally. This rate will further increase by 25% whenever DA increases by 50%.

iv.Reimbursement of Food charges :- There will be no separate reimbursement of food bills. Instead, the lump sum amount payable will be as per Table E(i) above and, depending on the length of absence from headquarters, would be regulated as per Table (v) below. Since the concept of reimbursement has been done away with, no vouchers will be required. This methodology is in line with that followed by Indian Railways at present (with suitable enhancement of rates). i.e. Lump sum amount payable. The lump sum amount will increase by 25 percent whenever DA increase by 50 percent.

V. Timing restrictions

| Length of absence | Amount Payable |

| If absence from headquarters is <6 hours | 30% of Lump sum amount |

| If absence from headquarters is between 6-12 hours | 70% of Lump sum amount |

| If absence from headquarters is >12 hours | 100% of Lump sum amount |

Absence from Head Quarter will be reckoned from midnight to midnight and will be calculated on a per day basis.

(vi) In case of stay/journey on Government ships, boats etc. or journey to remote places on foot/mules etc for scientific/data collection purposes in organization like FSI, Survey of India, GSI etc., daily allowance will be paid at rate equivalent to that provided for reimbursement of food bill. However, in this case, the amount will be sanctioned irrespective of the actual expenditure incurred on this account with the approval of the Head of Department/controlling officer.

Note : DA rates for foreign travel will be regulated as prescribed by Ministry of External Affairs.

3.T.A. on Transfer

TA on Transfer includes 4 components : (i) Travel entitlement for self and family (ii) Composite Transfer and packing grant (CTG) (iii) Reimbursement of charges on transportation of personal effects (iv) Reimbursement of charges on transportation of conveyance.

(i) Travel Entitlements :

a. Travel entitlements as prescribed for tour in Para 2 above, except for International Travel, will be applicable in case of journeys on transfer. The general conditions of admissibility prescribed in S.R.114 will, however, continue to be applicable.

b. The provisions relating to small family norms as contained in para 4(A) of Annexure to M/o Finance O.M. F.No. 10/2/98-IC & F.No. 19030/2/97-EIV dt. 171, April 1998 , shall continue to be applicable.

(ii)Composite Transfer and Packing Grant (CTG) :

a.The Composite Transfer Grant shall be paid at the rate of 80% of the last month’s basic pay in case of transfer involving a change of station located at a distance of or more than 20 kms from each other. However, for transfer to and from the Island territories of Andaman, Nicobar & Lakshadweep, CTG shall be paid at the rate of 100% of last month’s basic pay. Further, NPA and MSP shall not be included as part of basic pay while determining entitlement for CTG.

b.In cases of transfer to stations which are at a distance of less than 20 kms from the old station and of transfer within athe same city, one third of the composite transfer grant will be admissible, provided a change of residence is actually involved.

c.In cases where the transfer of husband and wife takes place within six months, but after 60 days of the transfer of the spouse, fifty percent of the transfer grant on transfer shall be allowed to the spouse transferred later. No transfer grant shall be admissible to the spouse transferred later, in case both the transfers are ordered within 60 days. The existing provisions shall continue to be applicable in case of transfers after a period of six months or more. Other rules precluding transfer grant in case of transfer at own request or transfer other than in public interest, shall continue to apply unchanged in their case.

(iii) Transportation of Personal Effects

| Level | By Train/Steamer | By Road |

| 12 and above | 6000 Kg by goods train/4 wheeler wagon/ 1 double container | Rs.50/- per Km |

| 6 to 11 | 6000 Kg by goods train/4 wheeler wagon/ 1 single container | Rs.50/- per Km |

| 5 | 3000 kg | Rs.25/- per Km |

| 4 and below | 1500 kg | Rs.15/- per Km |

The rates will further rise by 25 percent whenever DA increases by 50 percent. The rates for transporting the entitled weight by Steamer will be equal to the prevailing rates prescribed by such transport in ships operated by Shipping Corporation of India. The claim for reimbursement shall be admissible subject to the production of actual receipts/ vouchers by the Govt. servant. Production of receipts/vouchers is mandatory in r/o transfer cases of North Eastern Region, Andaman & Nicobar Islands and Lakshadweep also.

Transportation of personal effects by road is as per kilometer basis only. The classification of cities /towns for the purpose of transportation of personal effects is done away with.

[post_ads_2]

(iv) Transportation of Conveyance.

| Level | Reimbursement |

| 6 and above | 1 motor car etc. or 1 motor cycle/scooter |

| 5 and below | 1 motorcycle/scooter/moped/bicycle |

The general conditions of admissibility of TA on Transfer as prescribed in S.R. 116 will, however, continue to be applicable.

4. T.A. Entitlement of Retiring Employees

TA on Retirement includes 4 components : –

(i) Travel entitlement for self and family (ii) Composite Transfer and packing grant (CTG) (iii) Reimbursement of charges on transportation of personal effects (iv) Reimbursement of charges on transportation of conveyance.

(i) Travel Entitlements

Travel entitlements as prescribed for tour/transfer in Para 2 above, except for International Travel, will be applicable in case of journeys on retirement. The general conditions of admissibility prescribed in S.R.147 will, however, continue to be applicable.

(ii)Composite Transfer Grant(CTG)

a.The Composite Transfer Grant shall be paid at the rate of 80% of the last month’s basic pay in case of those employees, who on retirement , settled down at places other than last station(s) of their duty located at a distance of or more than 20 km. However, in case of settlement to and from the Island territories of Andaman, Nicobar & Lakshadweep, CTG shall be paid at the rate of 100% of last month’s basic pay. Further, NPA and MSP shall not be included as part of basic pay while determining entitlement for CTG. The transfer incidentals and road mileage for journeys between the residence and the railway station/bus stand, etc., at the old and new station, are already subsumed in the composite transfer grant and will not be separately admissible.

b.As in the case of serving employees, Government servants who, on retirement, settle at the last station of duty itself or within a distance of less than 20 kms may be paid one third of the CTG subject to the condition that a change of residence is actually involved.

(iii) Transportation of Personal Effects :- Same as Para 3(iii) above.

(iv) Transportation of Conveyance :- Same as Para 3(iv) above.

The general conditions of admissibility of TA on Retirement as prescribed in S.R. 147 will, however, continue to be applicable.