7th Pay Commission - CCS (RP) Rules 2016: Frequently Asked Question & Clarification on Fixation of Pay, Option etc.

A PCSDA/CSDA

PC of A (Fys) Kolkata / PlFA/IFAs

CFA(Fys) Kolkata /JCDA(AF) Nagpur

Of late , this office is receiving queries regarding pay fixation under CCS(RP) Rules 2016.

3. This is for information and appropriate action under Rule.

Source: www.cgda.nic.in [click here to view/download]

CGDA, Ulan Batar Road, Palam, Delhi Cantt- 110010

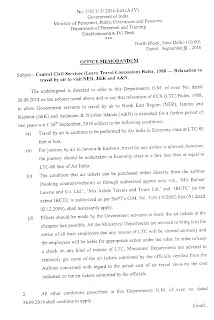

AN/XlV/14142/ Seventh cpc/Vol-l

Dated :- 08.09.2016

To,A PCSDA/CSDA

PC of A (Fys) Kolkata / PlFA/IFAs

CFA(Fys) Kolkata /JCDA(AF) Nagpur

Subject: Implementation of Seventh Central Pay Commission.

Of late , this office is receiving queries regarding pay fixation under CCS(RP) Rules 2016.

2. To avoid reference to this HQrs resulting in delayed action on account of fixation of pay , clarification to frequently asked questions by various controllers is placed below in tabular form for perusal and taking necessary action.

Sl.No. | Query raised | Clarification w.r.t. CCS(RP) Rules, 2016 |

1. | (i) Whether option to opt from 07/2016 (date of next increment) in cases where there is no promotion/ upgradation between 01/01/2016 to 30/06/2016 as the same has not been provided under Tulip. | (i)As regards opting from the date of increment(07/2016), reference is invited to Rule 5 and Rule 11 of CCS(RP) Rules 2016 which stipulates that a government servant may elect to continue to draw pay in the existing pay structure until the date on which he earns his next or any subsequent increment in the existing pay structure or until he vacates his post or ceases to draw pay in the existing pay structure. This implies that in cases where there is no promotion/ between 01/01/2016 to 30/06/2016 option to opt from 07/2016 thereby forgoing the arrears from 01/01/2016 to 30/06/2016 in addition to opting from 01/01/2016. Further, a Government servant who continues to draw his pay in the existing pay structure is brought over to the revised pay structure from a date later that 1St day of January 2016, his pay in the revised pay structure shall be fixed in the manner prescribed in accordance with clause (A) of sub rule (1) of rule 7’. |

2. | Tulip does not provide for contributing their entire arrear into GPF | It is clarified that Seventh Pay Commission does not lay down any provision for contributing entire GPF or part thereof into GPF account. Para 7 of Min. of Finance OM dated 29.07.2016 is self explanatory on issue. |

3. | Option to opt from Date of next increment (07/2016) in respect of cases related to promotion/MACP is not provided under Tulip. | As regards exercising option for seventh CPC from 07/2016 i.e on accrual of next increment in respect of cases who have been promoted/upgraded between 01.01.2016 and 30.06.2016 is concerned, Para 13 and Para 5 of CCS(RP) Rules 2016 may be referred which clearly states that in respect of the above cases, a government servant may elect to switch over the revised pay structure from the date of such promotion or upgradation implying that the option to switch over to the revised pay structure from 07/2016 is not available. Provision of para 15 of Min. of Finance Gazette notification dated 25.07.2016 may also be referred. |

4 | Methodology of pay fixation and DNl thereon in respect of Officers/staff who got promotion IMACP between 02.01.2016 to 01.07.2016. | Methodology of pay fixation in respect of cases which involve promotion from one level to another on or after 1st January 2016 has been illustratively described under Para 13 of CCS(RP) Rules 2016 |

5. | Computation of DA on TPTA along with other allowances. | Computation of DA on Transport Allowance has been clearly explained under Para 3 and Para 4 of MoF, Dept. of Exp OM No. 1-5/2016-IC dated 29.07.2016 reiterating that all allowances (except DA) will be continued to be paid at the existing rates in existing pay structure as if the pay had not been revised w.e.f. 01.01.2016 till further orders. |

6. | Whether the option to get his pay fixed under 7th CPC on 1st January or 1st July depending upon the date of appointment promotion or grant of financial up gradation is equally applicable in respect of pre 01/01/2016 cases. | The provisions of CCS(RP) Rules 2016 will apply to cases ( promotion, appointment etc) pertaining to the period after 01/01/2016. |

3. This is for information and appropriate action under Rule.

(T.K. Jajoria)

Sr. Dy. CGDA(AN)

Source: www.cgda.nic.in [click here to view/download]